Pakistani offers experienced selling tension on Monday as vulnerability encompassing the forthcoming monetary measures made the benchmark KSE 100 file become red in spite of an at first sure beginning in the midst of low volume.

Ahsan Mehanti of Arif Habib Enterprise said the market turned negative on reports that the immense Rs12.5 trillion proposed charge assortment focus for FY25 would influence modern profit.

He added that market feelings were additionally adversely impacted by over-utilizing and vulnerability in regards to the result of dealings to reimburse duty to Chinese IPPs.

Topline Protections Ltd said financial backers selected to manage their positions, making the market settle under 76,000 levels after an intraday high at 76,188, an increase of 204 focuses during the day. A moderately dreary force was seen during the meeting, fuelled by monetary worries and blended IMF flows.

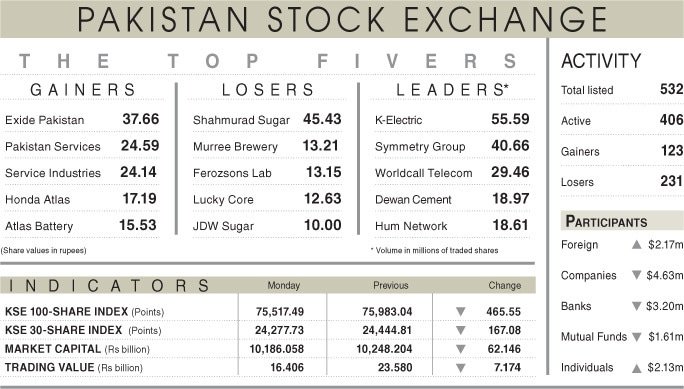

Thus, the compost, banks, and E&P areas contributed adversely, with Fauji Manure, MCB Bank, Pakistan Oil Ltd, OGDC and Bank Alfalah losing 251 focuses. In actuality, Faysal Bank, HBL, and Frameworks Ltd aggregately added 93 focuses. Thus, the KSE 100 record settled at 75,517.49 focuses subsequent to tumbling by 465.55 focuses or 0.61pc on a day-on-day premise.

In any case, the general exchanging volume fell 26.85pc to 446.07 million offers and the exchanged worth plunged by 30.42pc to Rs16.40bn day-on-day.

Stocks contributing essentially to the exchanged volume included K-Electric Ltd (55.59m offers), Balance Gathering Ltd (40.66m offers), WorldCall Telecom (29.46m offers), Dewan Concrete (18.97m offers) and Murmur Organization (18.61m offers).

The offers enrolling the most critical increases in their portion costs in outright terms were Exide Pakistan Ltd (Rs37.66), Pakistan Administrations Ltd (Rs24.59), Administrations Industries Ltd (Rs24.14), Honda Chart book Vehicles (Pakistan) Ltd (Rs17.19) and Chart book Battery Ltd (Rs15.53).

The organizations enlisting the significant abatements in their portion costs in outright terms were Shahmurad Sugar Plants Ltd (Rs45.43), Murree Brewery Organization Ltd (Rs13.21), Ferozsons Research centers Ltd (Rs13.15), Fortunate Center Businesses (Rs12.63) and JDW Sugar Factories Ltd (Rs10.00).

Unfamiliar financial backers turned net purchasers as they purchased shares worth $2.17m.